Support Centre – Tax – Emergency Basis

Emergency tax may be applied for a couple of reasons:

1. PPS Number (PPSN) has been given- Employment not Registered with Revenue

If you have provided a PPSN and your employment is not registered with Revenue, you may be taxed at a reduced emergency tax rate for the first four weeks of your employment.

.Calendar weeks 1-4:

Tax is charged at 20% on earnings up to a cut off point of €846 per week

Any income above €846pw will be taxed at 40%.

(Please note Calendar weeks are counted on a continuous basis from your first work date.)

Calendar week 5 onwards:

Tax is charged at 40% on all earnings until your employment is registered and the Revenue Payroll Notification (RPN) is available.

The USC is deducted from all earnings from the start and is at 8%.

How to Register Employment with Revenue?

1. If this is your first PAYE employment.

You will need to register this employment with revenue.

Here is the official link from Revenue explaining how to register your first job in Ireland:

"Starting your first job" — Revenue (Jobs & Pensions, myAccount)

cdn2.hubspot.net+15revenue.ie+15taxback.com+15

The steps are:

You will need to register for myAccount the first time you take on employment.

Go to the "Add Job or Pension Details" link under PAYE Services to register your job.Doing this triggers Revenue to issue a Revenue Payroll Notification (RPN) to your employer, ensuring the correct tax, USC, and credits are applied.

2. If this not your first PAYE employment

On receipt of your PPS Number we will request an RPN (tax cert) from revenue for you after your first work date with us. Once your employment has been registered you will come off of emergency tax.

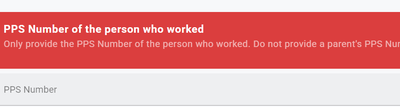

2. No PPS Number (PPSN)

If you have not provided a PPS Number

PAYE tax is charged at 40% on all earnings from the beginning.

USC is charged at 8% on all earnings from the start.

CHECK:

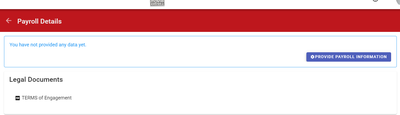

If you notice that Emergency Tax has been applied to your payslip the first step is to check the payroll section of your profile and ensure that you have provided your PPS Number.

If you have not you will see a request to input your payroll details by clicking on the blue 'Provide Payroll Information' button.

.

Make sure to save your details.